Full Transparency: The after effects of switching health plans

Truth is, not all stories have happy endings. Sadly, bad outcomes are completely avoidable but happen anyway. In our spirit of candor (we wouldn’t want it any other way) we decided to share a bit of the less fun side of group medical plans.

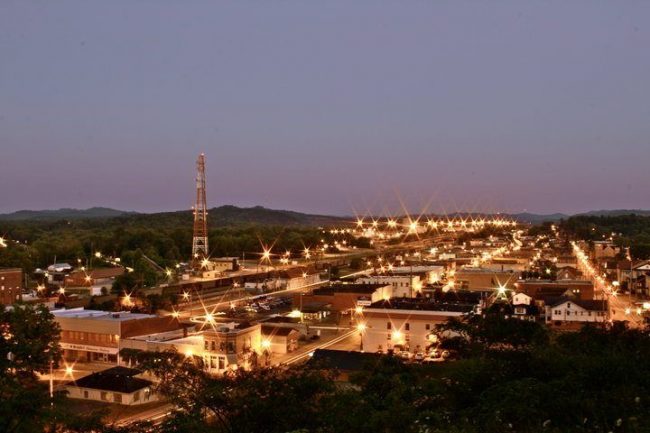

The city of Corbin, Kentucky has been a “WOW” client of ours for some time now, and with great success – we’ve slashed out-of-pocket costs and shown Big Checks that demonstrate how we saved them around $200k per year on their total healthcare spend. Recently, the city commission selected Anthem BlueCross Blue Shield to take over as the medical insurance provider for city employees for the fiscal year 2022. As you know, not all medical plans have a member’s best interest in mind. To that note, it was recently published that the city will receive its first health insurance rate increase in 5 years;

“The city will pay a monthly rate of $32,029, or $384,348 annually. Family plans will see a slight increase in costs for those employees who wish to add someone to their insurance plans. Sams said this would be the first health insurance rate increase in five years.”

The people of Corbin are some of the best, hardworking people around. They deserve the best healthcare options at a price that’s affordable. The main takeaway: Not all medical insurance plans are created equal. In fact, many medical insurance plans have one goal in mind; to increase profits for their shareholders at the expense of their “plan members”. The secondary takeaway; factors outside an adviser’s span of control may lose a long-term client. Just observing life here and I remain grateful for the time I was able to help the taxpayers of Corbin and their employees.

Pro Tip: Education is a continual process, custom plans require more ongoing education than “off-the-rack” solutions. Reporting alone is not enough, always be educating your clients.