It is spring and the Oak tree Helicopters are back and into my pool here in Kentucky, and buddy it is a pain to clean those out of the skimmer. As I was busy doing it, a great analogy came to mind…

Not only do most employers swim in polluted healthcare pools, but they choose to! So when did it all go wrong? How did Fully Insured carriers hypnotize the entire market into believing that choosing the “least bad increase” is a win? And most importantly – how did they turn it into the only available option?

In these series of articles and videos I tend to debunk the myth of healthcare, and give employers and their teams a chance to get measurable, predictable, and repeatable results from their healthcare plan.

The Problem

For most small to midsize employers, a healthcare benefits package is just an operational expense, or OP EX. Big box brokers, like a high cost Thoroughbred, offer a renewal with no control over the outcomes. It is what it is… That equity is not winning, it’s tearing up the ticket at the track after every race, losing the game…

Net effect, employers simply put another increase into the cost accounting structure for labor as a percentage and set it and forget it until next renewal… That’s running last with a high cost thoroughbred.

Brokers have trained entrepreneurs to be blind to the fact that their medical plan is a component of human capital, and an equity investment in the company. The majority of CFOs and COOs defer to HR who rely on their broker to simply try to meet the “industry standards” with huge chunks of owner equity.

Such an approach used to work 10, 15 and 20 years ago – but as healthcare becomes more expensive every year, its function within the organization should be re-evaluated.

Status Quo advisers work hard to deliver the cheapest solution expecting that businesses will fall for a promise that they are getting the lower price possible. However, spreadsheets have not prevented such Employers from huge opportunity costs by overpaying for their benefits plan.

Unfortunately, the Status Quo “dysfunctional” plans usually bring more damage to the company’s financial situation than any “PPO discounts” can cover. In other words, as an example – you save company money on healthcare – yet your plan transfers huge risks to your employees using ridiculously high deductibles and out of pocket limits.

it’s time to move from “settling” to winning the game of healthcare.

The Labor Pool

Post pandemic labor pool has shrunk: people still remember government subsidized free healthcare, and the corporate sector is trying to “sell them” on giving all of that up. If you find that the best talent and most experienced professionals – “family guys and gals” choose the competitors, look no further than your benefits. Human capital expense is at a premium and many companies have to overpay for employee acquisition.

Investment in Healthcare

The definition of “Investment” according to Investopedia is “any mechanism used for generating future income.” Therefore, you should examine your healthcare plan as an equity investment your organization makes on an annual basis. Here’s a simple, efficient level to pull for visible results of your efforts.

1. LOOK AT YOUR DEMOGRAPHICS

If most of your employees – current or potential – have a family, a great benefits package for you is a way of keeping operating costs low because employees are generally more likely to take a position at a lower salary when excellent health insurance benefits are provided. The reason is simple: a complicated medical condition that may occur, cannot be covered with an annual $10k+ raise.

It generally costs more for someone to obtain an individual or family health insurance policy than to get employer-sponsored coverage, making the difference of a lower salary possible.

2. FIND DIFFERENTIATING FACTOR

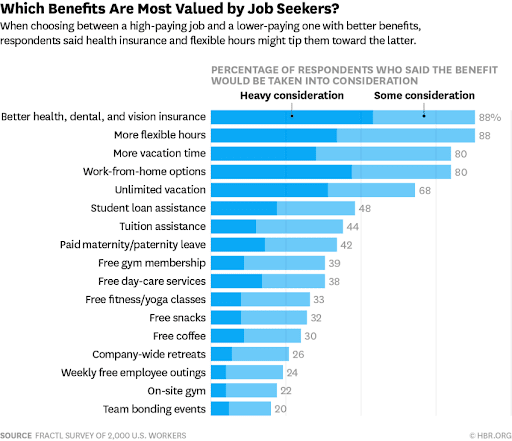

A study conducted by America’s Health Insurance Plan (AHIP) revealed that 46% of respondents said health insurance was either the deciding factor or a positive influence when choosing their current job. Salary continues to be a top motivator for job seekers, but benefits, such as healthcare coverage, follow closely behind. A Glassdoor survey looked at the top factors job seekers look for while looking through job ads.

The results showed that heavy consideration was given to salary – came in at 67%, better benefits at 63%, and location at 59%.

How can your company take advantage of that? Can you make the adjustment, promote it and deliver what the labor market demands or continue to give your benefits package a secondary role in the talent acquisition process?

Where Can You Learn More?

There are plenty of disappointments in how most employee benefits work, but we know how to stop being perceived as a profit center and nothing more. If you have questions about how this can work, you should get in contact with us. Our specialists are on-hand to discuss our options with you, so pick up the phone and give us a call today.