Alternative Ways to Battle High Hospital Prices

How much would you guess it costs to spend a day in the hospital? The average cost in March 2021 was between $1,606 to $3,726. If you or a loved one must stay for days or weeks, the cost is astronomical.

In fact, 60 of 65 percent of bankruptcy stem from overwhelming medical expenses. There are approaches employers can take to battle high hospital prices. Keep reading to learn how to reduce healthcare costs.

Read MoreFull Transparency: The after effects of switching health plans

Truth is, not all stories have happy endings. Sadly, bad outcomes are completely avoidable but happen anyway. In our spirit of candor (we wouldn’t want it any other way) we decided to share a bit of the less fun side of group medical plans.

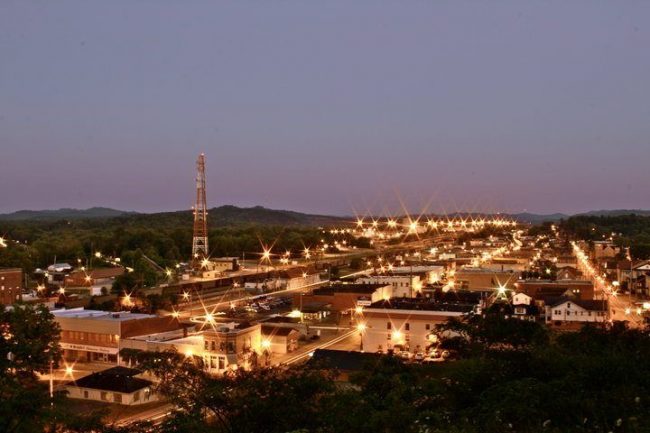

The city of Corbin, Kentucky has been a “WOW” client of ours for some time now, and with great success – we’ve slashed out-of-pocket costs and shown Big Checks that demonstrate how we saved them around $200k per year on their total healthcare spend. Recently, the city commission selected Anthem BlueCross Blue Shield to take over as the medical insurance provider for city employees for the fiscal year 2022. As you know, not all medical plans have a member’s best interest in mind. To that note, it was recently published that the city will receive its first health insurance rate increase in 5 years;

“The city will pay a monthly rate of $32,029, or $384,348 annually. Family plans will see a slight increase in costs for those employees who wish to add someone to their insurance plans. Sams said this would be the first health insurance rate increase in five years.”

The people of Corbin are some of the best, hardworking people around. They deserve the best healthcare options at a price that’s affordable. The main takeaway: Not all medical insurance plans are created equal. In fact, many medical insurance plans have one goal in mind; to increase profits for their shareholders at the expense of their “plan members”. The secondary takeaway; factors outside an adviser’s span of control may lose a long-term client. Just observing life here and I remain grateful for the time I was able to help the taxpayers of Corbin and their employees.

Pro Tip: Education is a continual process, custom plans require more ongoing education than “off-the-rack” solutions. Reporting alone is not enough, always be educating your clients.

Get a better set of eyes on your plan

Complimentary Healthcare Audit

Employee Benefits Costs Affect on PPP Forgiveness

Back in March of 2020, Congress passed the Paycheck Protection Program Act (PPP). Initial reports indicated that about 700,000 businesses were approved by July 6, 2020. It’s now time to start thinking about how to apply for forgiveness. As long as you meet certain spending requirements it shouldn’t be too much of an issue. Let’s look at the facts surrounding where your employee’s benefits fit into that equation.

The Goal of the Paycheck Protection Program (PPP)

The initial PPP set aside a maximum of $349 billion for forgivable loans. The goal was to help small businesses pay employees in the wake of the COVID-19 pandemic.

Details on PPP Eligiblity

Business owners with up to 500 employees are eligible to apply for this loan. They may use the initial PPP or First Draw PPP loans for the following:

- Payroll costs

- Employee benefits including health and retirement compensation

- Mortgage interest

- Rent

- Worker protection costs associated with COVID-19

- Utilities

- Certain supplier costs

- Certain expenses for operations

- Damage due to looting or vandalism during 2020 that was not insured

The PPP capped the payroll expenses at $100,000 on an annualized basis per employee. Maximum loan amounts can’t exceed the average payroll cost for two months plus 25 percent and the total loan cap is $10 million.

PPP Forgiveness Rules

The First Draw PPP has several rules governing who meets eligibility requirements for forgiveness. Here is a quick rundown of a few of those requirements:

- Self-employed, sole proprietors, independent contractors

- Small business meeting the SBA size standards

- NAICS businesses with a code beginning with 72 and more than one location and less than 500 workers per site

- 501(c)(3) non-profits, 502(c)(19) veteran companies, or tribal business concerns

- They must have no more than 500 employees unless they must meet SBA industry size rules.

- You may meet Second Draw PPP loan eligibility if you received a First Draw PPP. The first loan must be fully spent on authorized expenses.

Specific employee benefits play a part in the calculation of PPP loan forgiveness. The PPP Loan Forgiveness application has three lines addressing worker compensation.

Line 6

Employers enter the total amount paid for employee health insurance. This includes the contribution to employer-sponsored group health and self-insured plans. Don’t include pre-tax or after-tax payments made by employees.

Line 7

This line documents the total employer contribution for employee retirement plans. Pre-tax or after-tax payments by employees are excluded.

Retirement benefits include match, cash balance plan, and profit-sharing contributions. Remember that the PPP Forgiveness’ requires employers to use 75 percent of the loan for payroll. Compensation for retirement isn’t included in this 75 percent.

Line 8

Enter the total paid for employer state and local taxes. This includes charges for employee compensation such as state unemployment insurance tax. You don’t need to include taxes withheld from the worker’s earnings.

PPP Loan Forgiveness Deadline

While eligible businesses have until March 31, 2021, to apply for the First Draw PPP and the application window for the Second Draw PPP loan was between January 13 and March 31, 2021, forgiveness deadlines are more of a moving target. According to the SBA, “A borrower can apply for forgiveness once all loan proceeds for which the borrower is requesting forgiveness have been used. Borrowers can apply for forgiveness any time up to the maturity date of the loan.” In other words, it depends on when you got your money. The only other note is that if you do not apply for forgiveness within 10 months you will need to start making payments on the loan.

Part of Kentucky’s COVID Vaccine Rollout Was Almost Underwater

As of March 1, 2021, anyone over 60, anyone over 16 that might have any medical or behavioral health conditions, and all essential workers were eligible for Kentucky vaccines.

By the looks of the Kentucky vaccine rollout plan, it seems like everything is moving along swimmingly. However, you’d be shocked to learn that vaccines in one part of Kentucky almost came to a standstill!

Why was Kentucky’s COVID vaccine rollout almost underwater? Read on to find out.

Read MoreHow Lincoln County Saved More Than $180,000 on Health Care In Its Second Year of Being Self-Insured

The Opportunity: Lincoln County’s health care benefits costs were out of control. In a good year, their insurance rates would increase by 10%. In their worst years, they absorbed rate hikes as steep as 30-40%. As stewards of taxpayer dollars, they felt compelled to control these costs by completely re-evaluating their approach to health benefits.